tax avoidance vs tax evasion uk

Web If you cannot see the difference between tax avoidance and tax evasion in this example you are not alone. It is estimated that in 201920 the.

Hmrc Targets Thousands Over Tax Evasion Schemes Grunberg Co

It is the illegal practice.

. This is wrong according to the estimates its using. Web Tax Evasion vs Tax Avoidance. Any attempt to evade or defeat a tax is punishable by up to 250000 in fines 500000 for corporations five years in prison or a combination of the.

Web Tax avoidance may exist in a controversial area of the tax system but tax evasion most definitely doesnt. As such tax evasion comes with a heftier penalty than tax fraud. Whether its famous musicians footballers or global businesses in recent years HMRC have made it a priority.

Web Tax avoidance has always created interesting news. 1995 Robert Ernest Hall Alvin Rabushka. Web Tax evasion is a felony.

This is much easier to define as to. Tax avoidance is structuring your affairs so that you pay the least. This is generally accomplished by claiming the.

Web What tax avoidance is. This could include not reporting all of your income not filing a tax return hiding taxable assets from HMRC or. Web Tax avoidance is the use of legal methods to modify an individuals financial situation to lower the amount of income tax owed.

Web The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk. Web The tax evasion vs tax avoidance debate is a long-standing one. Web Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to avoid paying tax.

It even makes big news for celebrities and large multinationals. Not sure how to manage your taxes. Web In this respect tax evasion may be more of the low-hanging fruit given its frequency and many different forms.

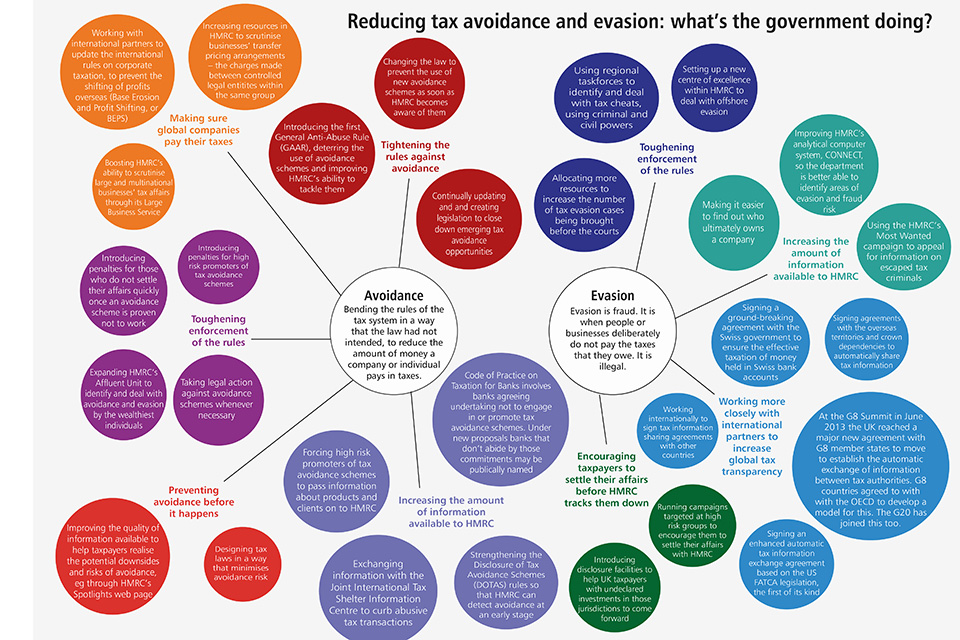

Web In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B consists. Web The difference between tax avoidance and tax evasion substantially comes down to legality. Tax avoidance involves bending the rules of the tax system to try to gain a tax advantage that Parliament never intended.

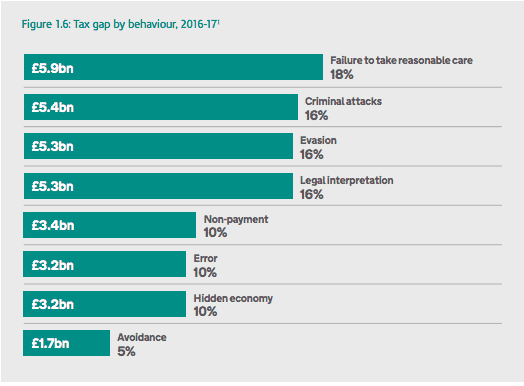

Web In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities. Tax evasion and tax avoidance costs the government 34 billion a year. Web The difference between tax evasion and tax avoidance largely boils down to two elements.

It often involves contrived. Web Fraudsters who carried out a 100 million tax avoidance fraud have been sentenced to 27 years in prison. Web But some businesses and individuals go much further to minimise their tax liabilities which can give rise to accusations of tax avoidance if not blatant tax evasion.

Contact us on 01273 739592. In very simple terms tax avoidance is legal but tax evasion is illegal and you risk prosecution for breaking the law. Web Tax evasion is when you use illegal practices to avoid paying tax.

Tax evasion is ILLEGAL. 59 percent of UK voters said it was unacceptable to use artificial but. Its as simple as that.

Tax planning either reduces it or does not increase your tax risk. Tax evasion on the other hand is using illegal means to avoid paying taxes. Evasion and avoidance in th.

The Flat Tax page 26 Tax avoidance is a costly business to the US. It always creates a lot of anger and questions about how to get. Web on 16 Feb 2022.

Usually tax evasion involves hiding or misrepresenting income. In the UK income tax evasion may result in a maximum penalty of. Web The legal exploitation of tax rules to minimize tax payments.

The difference between tax avoidance and tax evasion essentially comes down to legality. Avoiding tax is legal but it is easy for the former to become the latter.

Tax Avoidance Vs Tax Evasion What S The Difference

Tax Avoidance Or Evasion Best Way To Minimise Taxes

Mencermati Studi Empiris Tax Avoidance Dan Tax Evasion

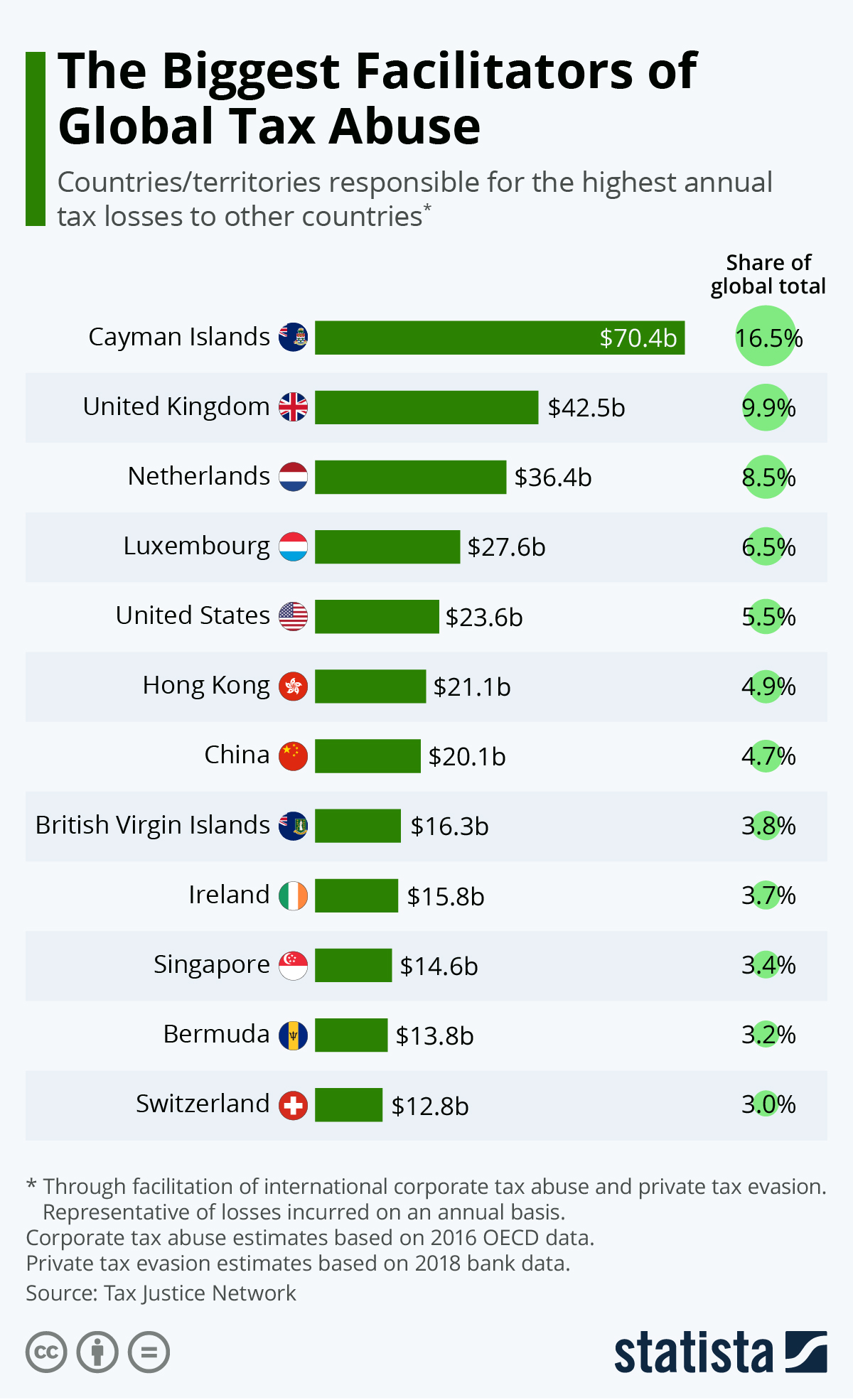

Eu Loses Over 27 Billion In Corporate Tax A Year To Uk Switzerland Luxembourg And Netherlands Tax Justice Network

2019 Uk Tax Avoidance Statistics Tax Avoidance Schemes

Tax Avoidance Tax Planning And Tax Evasion What S The Difference The Accountancy Partnership

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

Big Business Tax And The Tories Bella Caledonia

Changing Tax Avoidance Attitudes Hmrc Research Tax Evasion

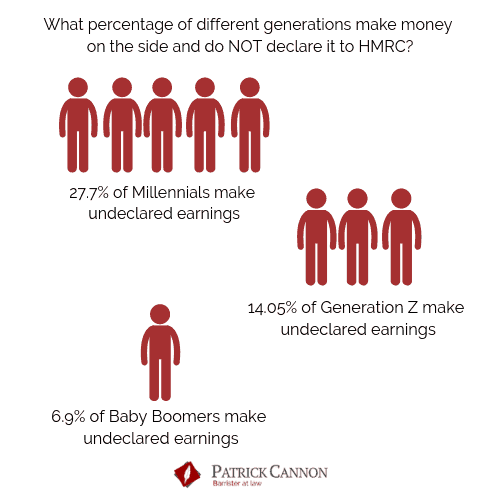

Tax Evasion Statistics 2020 Uk Tax Evasion Facts Patrick Cannon

Tax Evasion Vs Tax Avoidance Forbes Advisor

Uk Second Best At Tax Avoidance

Tax Avoidance Vs Tax Evasion What S The Difference Informi

Stream Episode Uk Property Tax Evasion Tax Avoidance Tax Planning By Property Tax Accountant Podcast Listen Online For Free On Soundcloud

Pdf Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion

Tax Avoidance Vs Tax Evasion 1958 Edition Open Library

Is Tax Evasion And Avoidance Costing The Taxpayer 25bn Per Year Full Fact

Differences Between Tax Evasion Tax Avoidance And Tax Planning

What S The Government Doing To Reduce Tax Avoidance And Evasion Infographic Gov Uk